Before investing in a timeshare property, you might want to first take a read of the article, Timeshare horrors: fresh hope for 100,000 people locked in costly contracts, published via The Telegraph News website. The article documents the reality of timeshare investing experienced by thousands, both in the UK and abroad.

Whilst the article highlights that changes in timeshare laws have brought good news for thousands, it also serves to highlight some of the concerns timeshare investors need to be aware of – and the size of those concerns. After all, there are reasons why the popularity of timeshares have plummeted in recent years, and here are some of the most common ones.

Mis-selling and Scams

Any industry more famous for its demise than its success should be approached with caution, and the timeshare industry is no exception. In fact, the timeshare industry serves as the perfect example of an industry which has gained more notoriety for the scams and scammers operating within it than for providing consumers with a realistic means of investing their money. Therefore, it is sensible to familiarise yourself with the most common forms of timeshare scams and mis-selling, which come in three forms – the cold call, junk mail, and presentations. With all the misinformation out there, you might be conned easily. It is best to research before making a decision. Look for the top timeshare exit companies, read up reviews, and even ask around to see if you can consult experts in this area. In any other case, you may end up draining your bank account along with a bad credit record.

Poor Financial Return

Many people lured by the concept of ‘the timeshare’ are so through thinking that firstly they are investing their money (and so can hope to garner some financial return upon its resale) and that they are purchasing property or into property. In almost all cases, this is untrue. As explained via the Timeshare Consumer Association website, timeshare offer little to no financial return. What is more, almost all ‘timeshare owners’ have purchased a share in the lease of a property and not shares in the property itself.

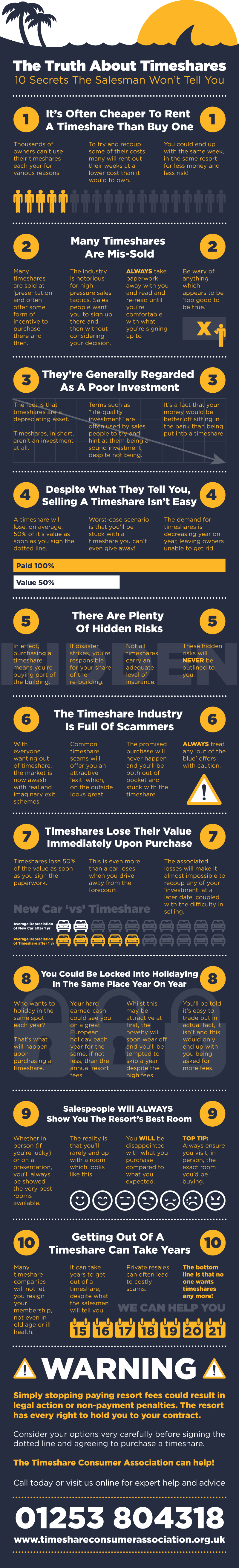

The TCA recently put together this infographic which outlines 10 secrets the salesman won’t tell you:

Re-Selling

As if the concerns surrounding timeshares and more worrying the credibility of the industry itself wasn’t worrying enough, those who have already invested in a timeshare face the problem of at some stage trying to re-sell it. And re-selling a timeshare can prove a big problem as the secondary market for resale timeshares can be almost non-existent. If there are lucky, they might find someone willing to buy their share, otherwise, they could go look up various timeshare exit companies who have experience with re-selling of timeshares.

The waning popularity of timeshares in recent times means that timeshare owners stand to make a loss and often a massive one on the successive sale of their timeshare. Further, scammers being aware of this (and ironically perhaps even partly if not largely to blame for this reality) actively seek those attempting to sell their timeshare, luring would-be sellers with offers that suppose to ensure timeshare owners ‘get a good deal’ when in reality this couldn’t be further from the truth.